GOPC Legislative Update September 2015

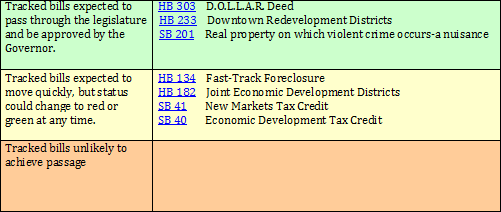

The following grid is designed to provide you with insight into the likelihood of passage of the legislation we are monitoring. Please note that due to the fluid nature of the legislative process, the color coding of bills is subject to change at any time. GOPC will be regularly updating the legislative update the last Thursday of every month and when major developments arise. If you have any concerns about a particular bill, please let us know.

Explanation of Bill Impact on Economic Development within Ohio:

HB 134 is sponsored by Representative Cheryl Grossman (R-Grove City) and Representative Mike Curtin (D-Marble Cliff). This bill would expedite the foreclosure and transfer of unoccupied, blighted parcels in cities with Housing Courts (Cleveland and Toledo) or Environmental Courts (Columbus/Franklin County). Many communities continue to struggle to mitigate the impact of blighted properties in their neighborhoods. HB 134 provides a framework to shorten the foreclosure timeline to move properties from “limbo” to responsible end users.

HB 182 is sponsored by Representative Kirk Schuring (R-Canton). HB 182 will enable townships, cities, and villages to cooperatively address concerns associated with diminishing local revenues, economic development, growth, and annexation pressures. The bill is a local community approach to solving economic development issues by providing local governments the ability to enter into legal agreements that will increase revenues and create jobs.

HB 233 is sponsored by Representative Kirk Schuring (R-Canton). HB 233 authorizes municipal corporations to create downtown redevelopment districts and innovation districts for the purpose of promoting the rehabilitation of historic buildings and promoting economic development in commercial and mixed-use residential areas.

HB 303 is sponsored by Representatives Jonathan Dever (R-Madeira) and Robert McColley (R-Napoleon). This Deed Over, Lender Leaseback, Agreed Financing (D.O.L.L.A.R. Deed) Programwould direct the Ohio Housing Finance Agency to administer a loss mitigation alternative for borrowers who are default on a mortgage encumbering a parcel of real property. HB 303 would allow homeowners to remain in their homes as a tenant instead of foreclosing on the property. This legislation will supply an additional tool to fight the abandoned property epidemic in Ohio and help prevent foreclosures and blight.

SB 40 is sponsored by Senator Bill Beagle (R-Tipp City). The Ohio Neighborhood Infrastructure Assistance Program (NIAP) would provide tax credits to individuals and for-profit corporations that invest in place-based catalytic neighborhood projects with non-profit organizations across Ohio. The NIAP is about businesses and residents investing in their communities for catalytic change. SB 40 would help communities achieve place based projects, which are essential for thriving communities. Additionally, the bill would facilitate job growth within our most vulnerable communities.

SB 41 is sponsored by Senators Bill Beagle (R-Tipp City) and Charleta Tavares (D-Columbus). Continuing law authorizes a nonrefundable tax credit with a four-year carryforward against the insurance and financial institution taxes for insurance companies and financial institutions that purchase and hold securities issued by low income community organizations to finance investments in qualified active low-income community businesses in Ohio, in accordance with the federal New Markets Tax Credit law.

SB 201 is sponsored by Senators Jim Hughes (R-Columbus) and Kenny Yuko (D-Richmond Heights). SB 201 would add “an offense of violence” to the section of state law that authorities use in court to board up properties. The bill would give city prosecutors an additional tool to deal with nuisance problems faced in cities and in rural areas.

Please check our blog for regular updates on legislation as it progresses within the House and Senate chambers.